retroactive capital gains tax increase

Yet the rate tables provided by Service Canada occasionally deviate from this rule resulting in a larger reduction. And part of the plan is making the new short-term capital gains tax retroactive to April 2021.

The Proposed Build Back Better Act Moves Forward After The House Passes A Revised Version Of The Bill Polsinelli Jdsupra

Tax capital gains on unrealized appreciation of assets held in trust if capital gains have not been paid on a property for 90 years.

. Because of these differences inheritance taxes can appropriately take into account the characteristics of heirs like their income level or the amount they inherited. Washington implemented a 7 percent tax on long-term net capital gains in excess of 250000 beginning January 1 2022. The percentage of the capital gains tax you will face when you sell your home will depend on your yearly income including the capital gains.

The loss you carry back cannot be more than the taxable. Here is how the taxes on income break out for single individuals in 2016. The inheritance tax can be also integrated with an income tax by repealing the income-tax exemption for receiving inheritances in the case of extraordinarily large inheritances.

Increase Enrollment 1a From Self Only to Self and Family From One Plan or Option to Another Cancel or Decrease Enrollment 1b Participate Waive When a Health Benefits Election Form Must be Filed With the Employing Office. The measuring period of time begins in 1940 or the date of acquisition whichever is later. While the change is retroactive to January 1 2021 New Yorks individual income tax increase is notable as one of only two individual income tax rate increases implemented in the last year.

Triggering the realization of these available capital gains will create CDA that can then be distributed as a tax-free capital dividend. An additional complication has been. Corporate income tax Tax rate increase for taxpayers with New York State income over 5 million For taxable years.

The intent of this provision is to tax appreciated assets held in generation-skipping trusts. Importantly two tax brackets were. The tax rate may increase as taxable income increases referred to as graduated or progressive tax rates.

Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases eg. This may be what you mean by the rate tables being complex. The Old Age Security Act specifies that the GIS should be reduced by 50 cents for every dollar lets ignore employment income capital gains issues etc.

Change from excluded position. 0 37650 in yearly income 0 capital gains. The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate.

Thats just 03 of. Real estate retirement savings accounts livestock and timber are exempt from taxation. Now I dont mean to scare you.

On November 2 2021 the law was the subject of a non-binding advisory vote where 61 percent of voters expressed their desire to repeal the tax. Although earnings grow on a tax-deferred basis if a policyholder withdraws funds before they reach the age of 59½ any investment gains would be subject to. If you are applying it against taxable capital gains realized in 2018 2019 or 2020 you do not need to make any adjustment because the inclusion rate is the same in all three years.

This was the month it was first announced. So property acquired in 1940 would have its appreciation. As part of the FY 2022 Enacted Budget Bill New Yorks top marginal rate for individual income taxation increased from 82 percent to 109 percent.

37650 415050 in yearly income 15 capital gains. 6 New York City did not plan to phase out its tax on business capital and. I have asked Service Canada to.

In accordance with Rules 456b and 457r under the Securities Act of 1933 as amended or the Securities Act the registrant is deferring payment of all of the registration fee and will the pay registration fee subsequently in advance or on a pay-as-you- go basis except for 4202275 of unutilized fees relating to 323750000 aggregate offering price of securities. The business capital tax rate prior to 2016 had been 015 and was gradually being phased out of existence with the rate previously scheduled to go to zero percent in 2021. These numbers will change from year to year.

This Budget proposes to levy capital gains tax on transfer of any such digital assets at a whopping 30 per cent without the benefit of any expense deduction other than cost of acquisition or. Initial opportunity to enroll for example. Although tax will be payable on the gain inside the corporation distributing a combination of taxable and capital dividends may be beneficial when compared with just paying a taxable dividend.

Method A - You can carry back a 2021 net capital loss to reduce any taxable capital gains in any of the three tax years before the year of death. If youre reading this you probably dont fall into this top tax bracket The top bracket in the new plan only applies to households with an income of 1 million or more per year. Temporary employee who completes 1 year of service and is.

Capital Gains Tax Increases Will Accelerate M A Activity In 2021capital Gains Tax Increases Will Accelerate M A Activity In 2021

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

Capital Gain Rate Capital Gains Tax Rate 2021

Understanding The Proposed Retroactive Capital Gains Tax Rate Increase Frazier Deeter Llc

Managing Tax Rate Uncertainty Russell Investments

What Can The Wealthy Do About Biden S Proposed Tax Increases

The Capital Gains Rate Historical Perspectives On Retroactive Changes Lexology

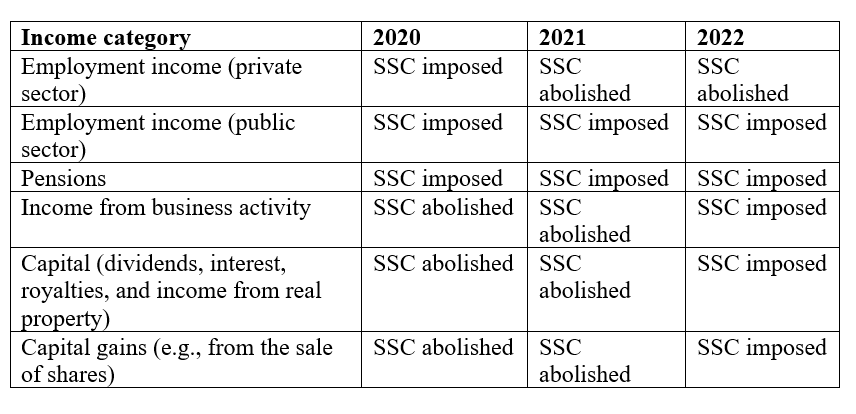

Greece Enacts Corporate Tax Rate Reduction Other Support Measures Mne Tax

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

![]()

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Higher Capital Gains Taxes Daily Market Update Lpl Financial Research

Possible Retroactive Capital Gains Hike Panics Investors Qsbs Holders Could Be At Risk Qsbs Expert

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

.png)

Biden S Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

Biden S Ex Post Facto Capital Gains Tax Increase Wsj

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

Biden Budget Reiterates 43 4 Top Capital Gains Tax Rate For Millionaires